Cobalt Juniors in Play Again Soon?

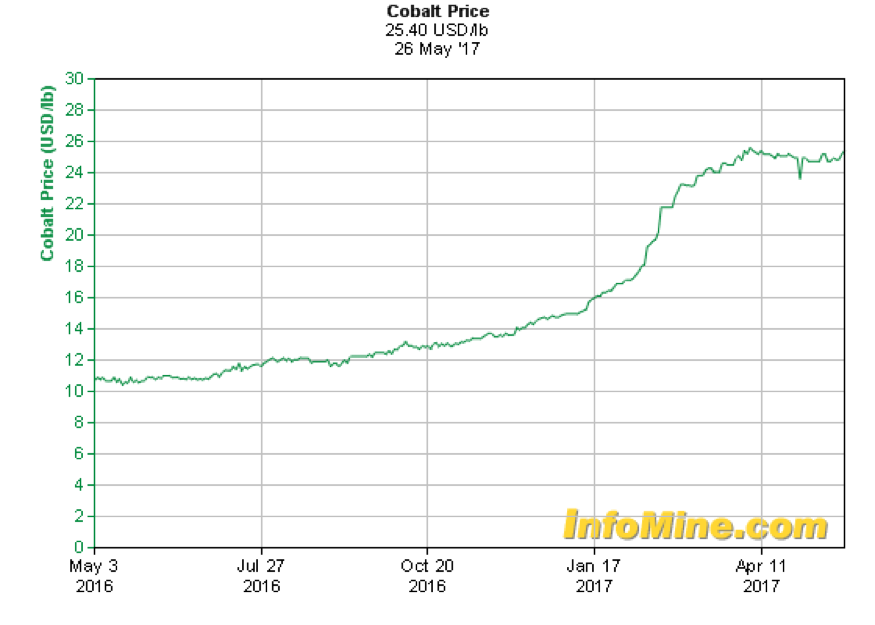

I think so. In fact, I’m quite confident that cobalt itself and in particular the companies looking for it or producing it are going higher. Cobalt prices have soared 150% in the past year going from just over $10 to over $25 per pound, yet it seems that many investors are unaware. Cobalt, like lithium, is a critical component in lithium ion batteries. The problem is that demand is greatly outstripping supply and over half of all cobalt comes from the DRC (Congo), plagued by serious child labor abuses and political instability.

I am not going to dive deeply into the macro argument for cobalt nor the micro validity of the projects owned by the companies I’m long. Instead, this is essentially a technical alert and shares of both Cruz Cobalt (CUZ.V/BKTPF) and Fortune Minerals (FT.TO/FTMDF) can be bought about 40% cheaper than their January 2017 highs. If they recover to test those highs, traders/investors could generate 50-60% returns. I’m targeting 40-50% returns in each stock by the end of the year, which isn’t bad!

The charts are set up as such that stop loss limits of 15% can be implemented to protect downside risk. The Cruz Cobalt weekly chart looks quite ripe for a run to 30 cents in the coming weeks/months…

Forgive the markings but I wanted to point out the RSI back at mid-level (51) working completely off the overbought conditions in 2016 and early 2017. The 50 week moving average at 18 cents has held up keeping higher highs/lows intact, which is bullish. If investors give the 50 week MA 15% leeway you have the 200 week MA as the back stop. If that is broken on the downside then something is wrong and I would close out the trade. But, unless that happens, this stock is going higher and we recently saw a “golden cross” last month where the 50 WMA bested the 200 WMA, also quite bullish. I’m forecasting a 50% move in CUZ to .285 from yesterday’s closing price of 19 cents. A retest of the previous high at 32 cents would be a 60% gain from here with 15% downside.

If cobalt continues its ascent, new highs are quite feasible as well. The top trend line blue arrow points to where resistance would be I that case, around 40 cents. High .30’s if it happens sooner (June-July) and low .40’s if it happens later (August-November).

We see the same setup in Fortune Minerals:

This is also a clearly bullish chart although the golden cross has yet to be confirmed and a stop limit at the 50 WMA in this case would be more like 20-25% versus 15% in CUZ. I think they are both going higher but personally own 3 times more CUZ than FT, although Fortune is lower risk. FT is later stage in their asset development versus Cruz which is a prospect generator model. Pick your fancy as they will both trade with the sector yet I find their charts to be similarly compelling. A similar 40-50% move in Fortune is my target as well (30 cents CDN).

In the case of Cobalt the “trend is your friend” and until it is broken on the downside the smart money is staying long. I feel that I am playing this relatively “safe” by just taking the meat out of the next movement which looks pretty clear to me. That approach versus hoping that cobalt will rise indefinitely and CUZ/FT trade to $2 each is preferred for me at this stage. Certainly with a 50% trading profit, if it materializes, I likely will let me “free shares” in both ride and see where this market goes in time.

The fundamentals of the cobalt market (along with lithium) are worth exploring further. Cruz actually has a fairly good bullet page about the dynamics that can be read here.

Again, Fortune is much further along with over $100 million having been put to work/invested in their flagship project. Their PPT also has good data on the cobalt marketplace.

For updates on Cruz Cobalt (CUZ.V/BKTPF) and Fortune Minerals (FT.TO/FTMDF and other special situations, alternative investments, and private placements, please sign up for our free newsletter below:

I’m long CUZ/FT…..be sure to sign up for updates on these trading positions.